MERGERS & ACQUISITIONS

Buying a franchise is not like starting an independent business. With a franchise, you are buying a support system and the rights to operate a business that has been designed by someone else. Someone who has developed an expertise in the business and who has, most likely, tackled and solved the problems that people generally encounter in the industry you are thinking of entering. You are buying the security of a track record, a brand and operating, reporting and management systems. With a franchise, you are purchasing a head start in the industry and a foothold from which to begin your climb.

It’s important not to be misled, though. Even though a franchise can give you many advantages over starting a business yourself, it’s not going to guarantee you success. Each and every individual business—franchise or not—has one major difference. That difference is YOU. And with the statistics in your favor, franchising can be the method of owning a business that can allow you to succeed.

How Franchising Works

Franchising is not an industry. It is a method of distributing products and services that has been adopted by companies in more than 70 different industries. While often associated with highly recognizable restaurant brands, franchising is used by real estate, photo development, auto repair and many other businesses to expand. Franchising is an excellent way to be in business for yourself, but not by yourself. The franchise agreement spells out the mutual obligations and responsibilities between the franchisor and franchisee. The franchisor developed the operating system and owns the right to it, along with the name and trademark. The franchisee invests in a license to use the intellectual property and business plan of the franchise. Although some systems differ, most require the franchisee to make ongoing royalty payments in return for an ongoing license to use the trademark and the franchise system’s most valuable assets. Thus, the intellectual property, operating plan and other proprietary information are protected in order to ensure the highest possible return on the franchisee’s investment in the brand. Franchising is successful because consumers rely on the assurance of consistency, quality, reputation and value. In franchising, predictability is a good thing - - the public knows what it is going to get at a hotel or motel along the highway, or that it can count on a particular meal experience at any restaurant in a chain. Protection of the brand and the uniform delivery of a product or system are the foundations of the franchisee’s investment and the keys to success for a franchise system.

The mutually beneficial relationship that exists between franchisors and franchisees makes franchising unique in the world of business. It provides entrepreneurs with an affordable means of accelerating expansion, achieving development goals more quickly than might otherwise be the case and with far less risk. Similarly, franchisees have a head start because of the support provided by the franchise system. Franchising is, literally, being in business for yourself but not by yourself. Whether it's accounting and financing, advertising and public relations, personnel management, purchasing or inventory control, franchisors are there to provide "hands on," one-to-one assistance. While franchising does provide opportunities, it does not create miracles. Franchisees combine knowledge and resources with entrepreneurial drive and spirit to form a business relationship unique to franchising. Franchising is a field of expanding economic opportunity in which each and every person can play a part based on talent, initiative, and dedication.

Strategic Growth / Strategic Divestiture

100% SUCCESS RATE

WE WILL DEVELOP AND BUILD YOUR FRANCHISE BUSINESS AND THEN SELL YOUR EQUITY TO OUR PRE-QUALIFIED INVESTORS OR OBTAIN INVESTMENT CAPITAL TO EXPAND YOUR OPPORTUNITIES

United

States Franchise M&A Associates is a premier Mergers & Acquisitions firm

serving middle market companies. We proactively represent visionary franchise

business owners to the ever changing marketplace of buyers and sellers.

Whether you are interested in Growth through Acquisition or Strategic Divesture

- our mission is to achieve your goals.

Since 2001, USFA skilled professionals, led by a team of successful former

franchise business owners, have developed and perfected M&A methodologies

that move the market to your advantage:

Our

franchised agencies are

strategic assets with a sales price multiple of 3 to 5 times net income and

makes a perfect investment for your future goals.

STRATEGIC

ACQUISITION

We specialize in buy-side clients

STRATEGIC DIVESTITURE

We work with sell-side clients

Technology and Franchising

There are several trends related to the use of technology in franchising today. 1) many franchisors use the internet to communicate with franchise owners and suppliers through secure extranets in order to share critical information, facilitate discussion among the franchise network, post operations manuals and updates, disseminate news about ad campaigns, engage in supply chain management, and gather sales reports automatically and without the need for more labor-intensive data entry. 2) franchisors use the internet to advertise their network to customers. 3) some franchisors use the internet to engage in business-to-consumer (B2C) e-commerce, often with the involvement of franchisees. 4) many prospective franchisees glean information and make contact with franchisors using the internet. Some franchisors now report that they get more sales leads from the internet than from any other source. 5) and finally, franchisors make extensive use of technology in offering their services directly to consumers -- such as networks of businesses that offer website design and web hosting. The prospects for, and reality of, involving technology in franchising make this a very exciting time to own a franchised business.

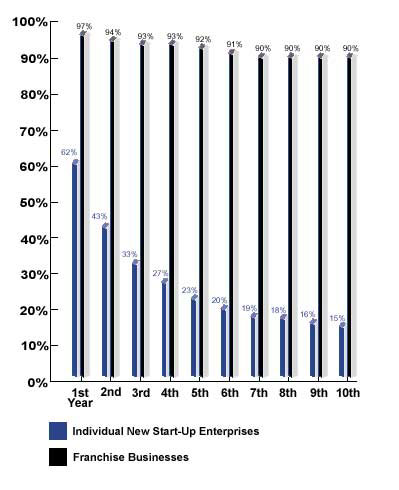

Franchising is growing at record levels each year. Currently, there are over 1.5 million franchised outlets, accounting for approximately one-third of all retail sales. Statistics show that 90% of franchise owners succeed in their businesses. So even though it does not guarantee success, statistics reveal that fewer than 10% of new franchise businesses fail. Compare that to the high failure rate of new businesses overall each year in the United States and you have a strong case for franchising.

Data from the U.S. Department of Commerce illustrate the business success rate over a ten-year period of Individual New Start-up Enterprises versus Franchise Businesses.

FDD RULE

Section I--Proposed Rule

PART 436--DISCLOSURE REQUIREMENTS AND PROHIBITIONS CONCERNING FRANCHISING

Section 436.1 Definitions.

Obligations of Franchisors and Other Franchise Sellers

436.2 The obligation to furnish documents.

The Contents of a Disclosure Document

436.3 Cover page.

436.4 Table of contents.

436.5 Disclosure items.

Instructions:

436.6 Instructions for preparing disclosure documents.

436.7 Instructions for electronic disclosure documents.

436.8 Instructions for updating disclosures.

Other Provisions

436.9 Exemptions.

436.10 Additional prohibitions.

436.11 Other laws, rules, orders.

436.12 Severability.

Sec. 436.1 Definitions.

Unless stated otherwise, the following definitions shall apply throughout this

rule:

(a) Action includes complaints, cross claims, counterclaims, and third party

complaints in a judicial proceeding, and their equivalents in an administrative

action or arbitration proceeding.

(b) Affiliate means an entity controlled by, controlling, or under common

control with the franchisor.

(c) Disclose means to state all material facts accurately, clearly, concisely,

and legibly in plain English.

(d) Financial performance representation means any oral, written, or visual

representation to a prospective franchisee, including a representation

disseminated in the general media and Internet, that states or suggests a

specific level or range of potential or actual sales, income, gross profits, or

net profits. A chart, table, or mathematical calculation that demonstrates

possible results based upon a combination of variables is a financial

performance representation.

(e) Fiscal year refers to the franchisor's fiscal year.

(f) Fractional franchise means a franchise relationship, which when the

relationship is created:

(1) The franchisee or any of the franchisee's current directors or officers has

more than two years of experience in the same type of business and

(2) The parties reasonably anticipate that the sales arising from the

relationship will not exceed more than twenty percent of the franchisee's total

dollar volume in sales during the first year of operation.

(g) Franchise means any continuing commercial relationship or arrangement,

whatever it may be called, in which the terms of the offer or contract specify,

or the franchise seller represents, orally or in writing, that:

(1) The franchisee obtains the right to operate a business or offer, sell, or

distribute goods, commodities, or services that are identified or associated

with the franchisor's trademark;

(2) The franchisor Exerts or has authority to exert a significant degree of

continuing control over the franchisee's method of operation, including but not

limited to, the franchisee's business organization, promotional activities,

management, or marketing plan or Provides significant assistance in the

franchisee's method of operation (e.g., the franchisee's business organization,

promotional activities, management, or marketing plan), extending beyond the

start of the business operation. Promotional assistance alone, however, will not

constitute ``significant'' assistance in the absence of other forms of

assistance and

(3) As a condition of obtaining or commencing operation of the business, the

franchisee is required by contract or by practical necessity to make a payment,

or a commitment to pay, to the franchisor or a person affiliated with the

franchisor.

(h) Franchise seller means a person that offers for sale, sells, or arranges for

the sale of an interest in a franchise. It includes the franchisor and its

employees, representatives, agents, and third party brokers. It does not include

franchisees who sell only their own outlets. Franchisee means any person who is

granted an interest in a franchise. Franchisor means any person who grants an

interest in a franchise and participates in the franchise relationship.

(k) Gag clause means any contractual provision entered into by a franchisor and

a current or former franchisee that prohibits or restricts that franchisee from

discussing his or her personal experience as a franchisee within the

franchisor's system. It does not include confidentiality agreements that protect

franchisors' trademarks or other proprietary information.

(l) Internet means all communications between computers and between computers

and television, telephone, facsimile, and similar communications devices. It

includes the World Wide Web, proprietary online services, E-mail, newsgroups,

and electronic bulletin boards.

(m) Leased department means an arrangement whereby a retailer licenses or

otherwise permits an independent seller to conduct business from the retailer's

premises.

(n) Material, material fact, and material change includes any fact,

circumstance, or set of conditions that has a substantial likelihood of

influencing a reasonable franchisee or prospective franchisee in making a

significant decision.

(o) Officer means any individual with significant management responsibility for

the marketing and or servicing of franchises, such as the chief executive and

chief operating officers, and the financial, franchise marketing, training, and

service officers. It also includes a de facto officer, namely an individual with

significant management responsibility for the marketing and/or servicing of

franchises whose title does not reflect the nature of the position.

(p) Person means any individual, group, association, limited or general

partnership, corporation, or any other business entity.

(q) Plain English means the organization of information and language usage

understandable by a person unfamiliar with the franchise business. It

incorporates the following six principles of clear writing: Short sentences;

definite, concrete, everyday language; active voice; tabular presentation of

information; no legal jargon or highly technical business terms; and no multiple

negatives.

(r) Predecessor means a person from whom the franchisor acquired, directly or

indirectly, the major portion of the franchisor's assets or from whom the

franchisor obtained a license to use the trademark or trade secrets in the

franchise operation.

(s) Principal business address means the address of the franchisor's home office

in the United States. A principal business address cannot be a post office box

or private mail drop.

(t) Prospective franchisee means any person (including any agent,

representative, or employee) who approaches or is approached by a franchise

seller to discuss the possible establishment of a franchise relationship.

(u) Required payment means all consideration that the franchisee must pay to the

franchisor or its affiliate, either by contract or by practical necessity, as a

condition of obtaining or commencing operation of the franchise.

(v) Sale of a franchise includes an agreement whereby a person obtains a

franchise or interest in a franchise for value by purchase, license, or

otherwise. It does not include extending or renewing an existing franchise

agreement where there is no interruption in the franchisee's operation of the

business, unless the new agreement contains terms and conditions that differ

materially from the original agreement.

(w) Signature means a person's affirmative steps to authenticate his or her

identity. It includes a person's written signature, as well as a person's use of

security codes, passwords, digital signatures, and similar devices.

(x) Trademark includes trademarks, service marks, names, logos, and other

commercial symbols.

(y) Written means any information in printed form or in any form capable of

being preserved in tangible form and read. It includes: type-set, word

processed, or handwritten documents; documents on computer disk or CD Rom;

documents sent via E-mail; or documents posted on the Internet. It does not

include mere oral statements.

Obligations of Franchisors and Other Franchise Sellers

Sec. 436.2 The obligation to furnish documents.

In connection with the offer or sale of a franchise to be located in the United

States of America, its territories, or possessions, unless the transaction is

exempted under the provisions of section 436.9, it is an unfair or deceptive act

or practice in violation of section 5 of the Federal Trade Commission Act:

(a) For any franchise seller to fail to furnish a prospective franchisee with

the following documents within the following time frames. The obligations set

forth in this subsection are satisfied if either the franchisor or other

franchise seller furnishes the required documents to the prospective franchisee:

(1) A current disclosure document. A copy of the franchisor's current disclosure

document, as described in sections 436.3-436.8, at least 14 days before the

prospective franchisee signs a binding agreement or pays any fee in connection

with the proposed franchise sale; and

(2) Completed franchise agreement. A copy of the completed franchise agreement,

and any related agreements, at least five days before the prospective franchisee

signs the franchise agreement.

(b) For purposes of this section, a franchise seller will be considered to have

furnished the documents by the required date if a copy of the document either a

paper copy or, with the consent of the prospective franchisee, an electronic

copy has been delivered to the prospective franchisee by that date, or if a copy

has been sent to the address specified by the prospective franchisee by first

class mail at least three days prior to the specified date. Documents shall also

be considered to have been furnished by the required date if a copy has been

sent by electronic mail or if directions for accessing the document on the

Internet have been provided to the prospective franchise by that date.

(c) For any franchisor to fail to include the information and follow the

instructions required by sections 436.3-436.8 in preparing the disclosure

document to be furnished to prospective franchisees. Any other franchise seller

shall be liable for violations of these sections if they knew or should have

known of the violation.

FRANCHISE DISCLOSURE DOCUMENT

Section 436.3 Cover page.

Begin the disclosure document with a cover page that consists of the following:

(a) The title ``FRANCHISE DISCLOSURE DOCUMENT'' in boldface type.

(b) The franchisor's name, type of business organization, principal business

address, telephone number, and, if applicable, E-mail address and primary

Internet home page address.

(c) A sample of the primary business trademark under which the franchisee will

conduct its business.

(d) A brief description of the franchised business.

(e) The total amounts in Item 5 (Initial Franchisee Fee) and Item 7 (Estimated

Initial Investment) of the disclosure document.

(f) The issuance date.

(g) The following statements in the order and form shown below:

(1) This disclosure document summarizes certain provisions of the franchise

agreement and other information in plain English. Read this disclosure document

and all agreements carefully. You must receive this disclosure document at least

14 days before you sign a binding agreement or pay any fee. You must also

receive completed copies of all contracts at least five days before you sign

them.

(2) If the franchisor furnishes an electronic version of its disclosure

document, also insert the following: You may have elected to receive an

electronic version of your disclosure document. If so, you may wish to print or

download the disclosure document for future reference. You have the right to

receive a paper copy of the disclosure document up until the time of sale. To

obtain a paper copy, contact name at address and telephone number.

(3) Buying a franchise is a complicated investment. The information contained in

this disclosure document can help you make up your mind. Note, however, that the

Federal Trade Commission (FTC) has not checked the information and does not know

if it is correct. Information comparing franchisors is available. Call your

State agency or your

public library for sources of information. Additional information on

franchising, such as ``A Consumer's Guide to Buying a Franchise,'' is available

from the FTC. You can contact the FTC in Washington, D.C., or visit the FTC's

home page at www.ftc.gov for further information. In addition, there may be laws

on franchising in your State. Ask your

State agencies about them.

(4) You should also know that the terms and conditions of your contract will

govern your franchise relationship. While the disclosure document includes some

information about your contract, don't rely on it alone to understand your

contract. Read all of your contract carefully. Show your contract and this

disclosure document to an advisor, like a lawyer or an accountant.

(5) Federal Trade Commission, Washington, DC 20580.

(h) Franchisors may include additional disclosures on the cover page, or on a

separate cover page, to comply with any applicable State presale disclosure

laws.

Section 436.4 Table of contents.

Include the following table of contents. State the page where each disclosure

Item begins. List all exhibits by letter, following the example shown below.

Table of Contents

1. The Franchisor, its Parent, Predecessors, and Affiliates

2. Business Experience

3. Litigation

4. Bankruptcy

5. Initial Franchise Fee

6. Other Fees

7. Estimated Initial Investment

8. Restrictions on Sources of Products and Services

9. Franchisee's Obligations

10. Financing

11. Franchisor's Assistance, Advertising, Computer Systems, and Training

12. Territory

13. Trademarks

14. Patents, Copyrights, and Proprietary Information

15. Obligation to Participate in the Actual Operation of the Franchise Business

16. Restrictions on What the Franchisee May Sell

17. Renewal, Termination, Transfer, and Dispute Resolution

18. Public Figures

19. Financial Performance Representations

20. Outlets and Franchisee Information

21. Financial Statements

22. Contracts

23. Receipt

FRANCHISE DISCLOSURE ITEM 1

Section 436.5 Disclosure Items 1.

ITEM 1: The Franchisor, Its Parents, Predecessors, and Affiliates.

(1) Disclose the name of the franchisor. Also disclose the names of any parent and affiliates of the franchisor and the relationship with the franchisor. For purposes of this paragraph the term``affiliate'' means an entity controlled by, controlling, or under common control with the franchisor, that offers franchises in any line of business or is providing products or services to the franchisees of the franchisor.

(2) Disclose the name of any predecessors during the 10 year period immediately before the close of the franchisor's most recent fiscal year.

(3) Disclose the name under which the franchisor does or intends to do business.

(4) Disclose the principal business address of the franchisor, its parent, predecessors, and affiliates, and the franchisor's agent for service of process.

(5) Disclose the type of business organization used by the franchisor (e.g., corporation, partnership), and the State in which it was organized.

(6) Disclose the following

information about the nature of the franchisor's business and the franchises to

be offered:

(i) Whether the franchisor operates businesses of the type being franchised;

(ii) The franchisor's other business activities;

(iii) The business to be conducted by the franchisee;

(iv) The general market for the product or service to be offered by the

franchisee. In describing the general market, consider factors such as whether

the market is developed or developing, whether the goods will be sold primarily

to a certain group, and whether sales are seasonal;

(v) In general terms, any laws or regulations specific to the industry in which

the franchise business operates; Only laws pertaining specifically to the

industry sector of the franchised business, and not businesses generally, must

be disclosed in this Item. For example, a real estate brokerage franchisor

should disclose the existence of broker licensing laws; an optical products

franchisor should disclose the existence of applicable optometrist/optician

staffing regulations and licensing requirements; a lawn care franchisor should

disclose that certain environmental laws regulating pesticide application to

residential lawns will require that franchisees post notices on treated lawns.

It is not necessary to include laws or regulations that apply to businesses

generally, such as general business licensing laws, tax regulations, or labor

laws.

(vi) A general description of the competition.

(7) Disclose the prior business

experience of the franchisor, its parent, predecessors, and affiliates,

including:

(i) The length of time each has conducted the type of business to be operated by

the franchisee;

(ii) The length of time each has offered franchises providing the type of

business to be operated by the franchisee; and

(iii) Whether each has offered franchises in other lines of business, including:

(A) A description of each other line of business;

(B) The number of franchises sold in each other line of business; and

(C) The length of time offering each other line of business.

FRANCHISE DISCLOSURE ITEM 2

ITEM 2: Business Experience. Disclose the position and name of the directors, trustees, general partners, officers, and subfranchisors of the franchisor or any parent who will have management responsibility relating to the offered franchises. List all franchise brokers. For each person listed, state the principal positions and employers during the past five years, including each position's beginning date, ending date, and location.

FRANCHISE DISCLOSURE ITEM 3

ITEM 3: Litigation.

(1) Disclose whether the

franchisor, its parent, predecessor, a person identified in paragraph (b) of

this section, or an affiliate who offers franchises under the franchisor's

principal trademark:

(i) Has pending against that person:

(A) An administrative, criminal, or material civil action alleging a violation

of a franchise, antitrust, or securities law, or alleging fraud, unfair or

deceptive practices, or comparable allegations; or

(B) Civil actions, other than ordinary routine litigation incidental to the

business, which are significant in the context of the number of franchisees and

the size, nature, or financial condition of the franchise system or its business

operations.

(ii) Is a party to any pending material civil action involving the franchise

relationship. For purposes of this paragraph, ``franchise relationship'' means

contractual obligations between the franchisor and franchisee directly relating

to the operation of the franchised

business (e.g., royalty payment and training obligations). It does not include

suits involving third-parties such as suppliers or indemnification for tort

liability.

(iii) Has during the 10 year period immediately before the disclosure document's

issuance date:

(A) Been convicted of a felony or pleaded nolo contendere to a felony charge;

(B) Been held liable in a civil action by final judgment. ``Held liable'' means

that, as a result of claims or counterclaims, the franchisor must pay money or

other consideration, must reduce an indebtedness by the amount of an award,

cannot enforce its rights, or

must take action adverse to its interests; or

(C) Been a defendant in a material action involving an alleged violation of a

franchise, antitrust, or securities law, or involving allegations of fraud,

unfair or deceptive practices, or comparable allegations.

\2\ Franchisors are not required to disclose actions that were dismissed by

final judgment without liability or entry of an adverse order. However,

franchisors must disclose dismissal of a material action in connection with a

settlement.

(iv) Is subject to a currently effective injunctive or restrictive order or

decree resulting from a pending or concluded action brought by a public agency

and relating to the franchise or to a Federal, State, or Canadian franchise,

securities, antitrust, trade regulation, or trade practice law.

(2) For each action identified in

paragraph (c)(1) of this section, state the title, case number or citation, the

initial filing date, the names of the parties, and the forum. State the

relationship of the opposing party to the franchisor (e.g., competitor,

supplier, lessor,

franchisee, former franchisee, or class of franchisees). Summarize the legal and

factual nature of each claim in the action, the relief sought or obtained, and

any conclusions of law or fact. In addition:

\3\ Franchisors may include a summary opinion of counsel concerning any action

if a consent to use the summary opinion is included as part of the disclosure

document.

(i) For pending actions, state the status of the action;

(ii) For prior actions, state the date when the judgment was entered and any

damages and/or settlement terms.

\4\ If a settlement agreement must be disclosed in this Item, all material

settlement terms must be disclosed, whether or not the agreement is

confidential. Because of difficulties in retrieving information and/or obtaining

releases from older confidentiality agreements, franchisors are not required to

disclose the settlement terms of settlements entered before April 15, 1993,

consistent with the policy adopted by the North American Securities

Administrators Association's Uniform Franchise Offering Circular Guidelines.

(iii) For injunctive or restrictive orders, state the nature, terms, and

conditions of the order or decree; and

(iv) For convictions or pleas, state the crime or violation, the date of

conviction, and the sentence or penalty imposed.

FRANCHISE DISCLOSURE ITEM 4

ITEM 4: Bankruptcy.

(1) Disclose whether the

franchisor, its parent, predecessor, a person identified in paragraph (b) of

this section or an affiliate who offers franchises under the franchisor's

principal trademark has, during the 10 year period immediately before the date

of this disclosure document:

(i) Filed as debtor or had filed against it a petition under the U.S. Bankruptcy

Code.

(ii) Obtained a discharge of its debts under the Bankruptcy Code; or

(iii) Been a principal officer of a company or a general partner in a

partnership that either filed as a debtor (or had filed against it) a petition

under the Bankruptcy Code or that obtained a discharge of its debts under the

Bankruptcy Code while or within one year after the officer or general partner

held the position in the company.

(2) For each bankruptcy:

(i) State the name, address, and principal business of the debtor;

(ii) If the debtor is not the franchisor, state the relationship of the debtor

to the franchisor (e.g., affiliate, officer); and

(iii) State the date of the original filing. Identify the bankruptcy court, and

the case name and number. If applicable, state the debtor's discharge date,

including discharges under Chapter 7 and confirmation of any plans of

reorganization under Chapters 11 and 13 of

the Bankruptcy Code.

(3) Disclose cases, actions, and other proceedings under the laws of foreign nations relating to bankruptcy, as if they took place under the Bankruptcy Code.

FRANCHISE DISCLOSURE ITEM 5

ITEM 5: Initial Franchise Fee.

Disclose the initial franchise fee and the conditions under which this fee is refundable. If the initial fee is not uniform, disclose the range or the formula used to calculate the initial fees paid in the fiscal year before the issuance date and the factors that determined the amount. For purposes of this Item, ``initial fee'' means all fees and payments for services or goods received from the franchisor before the franchisee's business opens, whether payable in lump sum or installments.

FRANCHISE DISCLOSURE ITEM 6

Item 6: Recurring or Occasional Fees.

Disclose, in the tabular form

shown below, any recurring or occasional fees that the franchisee must pay to

the franchisor or its affiliates, or that the franchisor or its affiliates

impose or collect in whole or in part on behalf of a third party. Include any

formula used to compute the fees. If fees may increase, disclose the formula

that determines the increase or the maximum amount of the increase. For example,

a percentage of gross sales is acceptable if the franchisor defines the term

``gross sales.''

----------------------------------------------------------------------------------------------------------------

(1) Type of fee (2) Amount (3) Due date (4) Remarks

----------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------

(1) In column (1), disclose the type of fee (e.g., royalties, and fees for lease

negotiations, construction, remodeling, additional training or assistance,

advertising, advertising cooperatives, purchasing cooperatives, audits,

accounting, inventory, transfers, and renewals).

(2) In column (2), disclose the amount of each fee.

(3) In column (3), disclose the applicable due date for recurring fees.

(4) In column (4), include any relevant remarks, definitions, or caveats that

elaborate on the information in the table. If remarks are lengthy, franchisors

may use footnotes instead of the remarks column. If applicable, include the

following information in the remarks column or in a footnote:

(i) If the fees are payable only to the franchisor;

(ii) If the fees are imposed and collected by the franchisor;

(iii) The terms and conditions under which any fee is refundable; and

(iv) The voting power of franchisor-owned outlets on any fees imposed by

cooperatives. If franchisor-owned outlets have controlling voting power,

disclose the maximum and minimum fees that may be imposed.

FRANCHISE DISCLOSURE ITEM 7

ITEM 7: Estimated Initial Investment.

Disclose, in the tabular form

shown below, the franchisee's estimated initial investment. Title the table

``Your Estimated Initial Investment For The First reasonable initial phase

Months.'' A reasonable initial phase is at least three months or a reasonable

period for the industry. Franchisors may include additional expenditure tables

to show expenditure variations caused by differences such as in site location

and premises size.

Your Estimated Initial Investment for the First [reasonable initial phase]

Months

----------------------------------------------------------------------------------------------------------------

(1)Type of expenditure (2)Amount (3)Method of payment (4)When due (5)To whom

paid

----------------------------------------------------------------------------------------------------------------

Total...........................

----------------------------------------------------------------------------------------------------------------

(1) In column (1), disclose each type of expense, beginning with pre opening

expenses. Include the following expenses, if applicable. Use footnotes to

comment on expenditures.

(i) The initial franchise fee.

(ii) Training expenses.

(iii) Real property, whether purchased or leased.

(iv) Equipment, fixtures, other fixed assets, construction, remodeling,

leasehold improvements, and decorating costs, whether purchased or leased.

(v) Inventory required to begin operation.

(vi) Security deposits, utility deposits, business licenses, and other prepaid

expenses.

(vii) List separately and by name any other specific payment (e.g., additional

training, travel, or advertising expenses).

(viii) Include an additional expense category named ``other payments'' for any

other miscellaneous expenses that the franchisee will incur before operations

begin and during the initial phase.

(2) In column (2), state the amount of the payment. If the specific amount is

not ascertainable, use a low high range based on the franchisor's current

experience. If real property costs cannot be estimated in a low high range,

disclose the approximate size of the property and building, and describe the

probable location of the building (e.g., strip shopping center, mall, downtown,

rural, or highway).

(3) In column (3), disclose the method of payment.

(4) In column (4), disclose the applicable due date.

(5) In column (5), disclose to whom payment will be made.

(6) Total the initial investment, incorporating ranges of fees, if used.

(7) Disclose in a footnote:

(i) The conditions under which each payment is refundable; and

(ii) If the franchisor or an affiliate finances part of the initial investment,

the amount that it will finance, the required down payment, the annual

percentage rate of interest, rate factors, and the estimated loan repayments.

Franchisors may refer the reader to Item 10 for additional details.

FRANCHISE DISCLOSURE ITEM 8

ITEM 8: Restrictions on Sources of Products and Services

Disclose the franchisee's obligations to

purchase or lease goods, services, supplies, fixtures, equipment, inventory,

computer hardware and software, real estate, or comparable items related to

establishing or operating the franchised business either from the franchisor,

its designee, or suppliers approved by the franchisor, or under the franchisor's

specifications. Include obligations to purchase imposed by the franchisor's

written agreement or by the franchisor's practice.4

Franchisors may include the reason for the requirement. Franchisors need not disclose in this Item the purchase or lease of goods or services provided as part of the franchise without a separate charge (such as initial training, if the cost is included in the franchise fee). Describe such fees in Item 5 of this section. Do not disclose fees already described in §436.5(f) of this part.

(1) The good or service required to be purchased or leased.

(2) Whether the franchisor or its affiliates are approved suppliers or the only approved suppliers of that good or service.

(3) Any supplier in which an officer of the franchisor owns an interest.

(4) How the franchisor grants and revokes approval of alternative suppliers, including:

(i) Whether the franchisor's criteria for approving suppliers are available to franchisees.

(ii) Whether the franchisor permits franchisees to contract with alternative suppliers who meet the franchisor's criteria.

(iii) Any fees and procedures to secure approval to purchase from alternative suppliers.

(iv) The time period in which the franchisee will be notified of approval or disapproval.

(v) How approvals are revoked.

(5) Whether the franchisor issues specifications and standards to franchisees, subfranchisees, or approved suppliers. If so, describe how the franchisor issues and modifies specifications.

(6) Whether the franchisor or its affiliates will or may derive revenue or other material consideration from required purchases or leases by franchisees. If so, describe the precise basis by which the franchisor or its affiliates will or may derive that consideration by stating:

(i) The franchisor's total revenue.

Take figures from the franchisor's most recent annual audited financial statement required in §436.5(u) of this part. If audited statements are not yet required, or if the entity deriving the income is an affiliate, disclose the sources of information used in computing revenues.

(ii) The franchisor's revenues from all required purchases and leases of products and services.

(iii) The percentage of the franchisor's total revenues that are from required purchases or leases.

(iv) If the franchisor's affiliates also sell or lease products or services to franchisees, the affiliates' revenues from those sales or leases.

(7) The estimated proportion of these required purchases and leases by the franchisee to all purchases and leases by the franchisee of goods and services in establishing and operating the franchised businesses.

(8) If a designated supplier will make payments to the franchisor from franchisee purchases, disclose the basis for the payment (for example, specify a percentage or a flat amount). For purposes of this disclosure, a “payment” includes the sale of similar goods or services to the franchisor at a lower price than to franchisees.

(9) The existence of purchasing or distribution cooperatives.

(10) Whether the franchisor negotiates purchase arrangements with suppliers, including price terms, for the benefit of franchisees.

(11) Whether the franchisor provides material benefits (for example, renewal or granting additional franchises) to a franchisee based on a franchisee's purchase of particular products or services or use of particular suppliers.

(i) Item 9 : Franchisee's Obligations .

Disclose, in the following tabular form, a list of the franchisee's principal

obligations. State the title “

FRANCHISE DISCLOSURE ITEM 9

ITEM 9: Franchisee's Obligations.

Disclose, in the tabular form shown below, a list of the franchisees' principal obligations. Cross reference each listed obligation with any applicable franchise agreement and disclosure document section(s). Respond to each listed obligation. If a particular obligation is not applicable, state ``Not Applicable.'' Include additional obligations, as is warranted. This table lists your principal obligations under the franchise and other agreements. It will help you find more detailed information about your obligations in these agreements and in other items of this disclosure document.

----------------------------------------------------------------------------------------------------------------

Obligation Section in agreement Disclosure document item

----------------------------------------------------------------------------------------------------------------

a. Site selection and ...................................

..........................................

acquisition/lease

b. Pre-opening purchases/leases ...................................

..........................................

c. Site development and other ...................................

..........................................

pre-opening requirements

d. Initial and ongoing training ...................................

..........................................

e. Opening ...................................

..........................................

f. Fees ...................................

..........................................

g. Compliance with standards ...................................

..........................................

and policies/operating manual

h. Trademarks and proprietary ...................................

..........................................

information

i. Restrictions on products/ ...................................

..........................................

services offered

j. Warranty and customer ...................................

..........................................

service requirements

k. Territorial development and ...................................

..........................................

sales quotas

l. Ongoing product/service ...................................

..........................................

purchases

m. Maintenance, appearance, and ...................................

..........................................

remodeling requirements

n. Insurance ...................................

..........................................

o. Advertising ...................................

..........................................

p. Indemnification ...................................

..........................................

q. Owner's participation/ ...................................

..........................................

management/staffing

r. Records and reports ...................................

..........................................

s. Inspections and audits ...................................

..........................................

t. Transfer ...................................

..........................................

u. Renewal ...................................

..........................................

v. Post-termination obligations ...................................

..........................................

w. Non-competition covenants ...................................

..........................................

x. Dispute resolution ...................................

..........................................

y. Other (describe)

-----------------------------------------------------------------------

FRANCHISE DISCLOSURE ITEM 10

ITEM 10: Financing.

(1) Disclose the terms and

conditions of each financing arrangement, including leases and installment

contracts, that the franchisor, its agent, or affiliates offers directly or

indirectly to the franchisee. The franchisor may summarize the terms of each

financing arrangement in tabular form, using footnotes to provide additional

information. For each financing arrangement, disclose: Payments due within 90

days on open account. financing are not required to be disclosed under this

section. Indirect offers of financing include a written arrangement between a

franchisor or its affiliate and a lender, for the lender to offer financing to a

franchisee; an arrangement in which a franchisor or its affiliate receives a

benefit from a lender in exchange for financing a franchise purchase; and a

franchisor's guarantee of a note, lease, or other obligation of the franchisee.

(i) A description of what the financing covers (e.g., the initial franchise fee,

site acquisition, construction or remodeling, initial or replacement equipment

or fixtures, opening or ongoing inventory or supplies, or other continuing

expenses). Include specimen copies of the financing documents as an exhibit to

paragraph (v) of this section. Cite the section and name of the document

containing the financing terms and conditions.

(ii) The identity of the lender(s) providing the financing and any relationship

to the franchisor (e.g., affiliate);

(iii) The amount of financing offered or, if the amount depends on an actual

cost that may vary, the percentage of the cost that will be financed;

(iv) The annual percentage rate of interest (``APR'') charged, computed as

provided by Sections 106-107 of the Consumer Protection Credit Act, 15 U.S.C.

1605-1606. If the APR may differ depending on when the financing is issued,

disclose the APR on a specified recent date;

(v) The number of payments or the period of repayment;

(vi) The nature of any security interest required by the lender;

(vii) Whether a person other than the franchisee must personally guarantee the

debt;

(viii) Whether the debt can be prepaid and the nature of any prepayment penalty;

(ix) The franchisee's potential liabilities upon default, including any:

(A) Accelerated obligation to pay the entire amount due;

(B) Obligations to pay court costs and attorney's fees incurred in collecting

the debt;

(C) Termination of the franchise; or

(D) Liabilities from cross defaults such as those resulting directly from

non-payment, or indirectly from the loss of business property; and

(x) Other material financing terms.

(2) Disclose whether any provisions of the loan agreement require franchisees to waive defenses or other legal rights (e.g., confession of judgment), or bar the franchisee from asserting a defense against the lender, the lender's assignee or the franchisor. If so, describe the relevant provisions.

(3) Disclose whether the

franchisor's practice or intent is to sell, assign, or discount to a third party

all or part of the financing arrangement. If so, disclose:

(i) The assignment terms, including whether the franchisor will remain primarily

obligated to provide the financed goods or services; and

(ii) That the franchisee may lose all its defenses against the lender as a

result of the sale or assignment.

(4) Disclose whether the franchisor or an affiliate receives any payments for

the placement of financing with the lender. If such payments exist:

(i) Disclose the amount or the method of determining the payment; and

(ii) Identify the source of the payment and the relationship of the source to

the franchisor or its affiliates.

FRANCHISE DISCLOSURE ITEM 11

ITEM 11: Franchisor's Assistance, Advertising, Computer Systems, and Training.

Disclose the franchisor's principal assistance and related obligations as described below. For each obligation, cite the section number of the franchise agreement imposing the obligation. Begin by stating: ``Except as listed below, [the franchisor] is not required to provide any assistance to you.''

(1) Disclose the franchisor's pre

opening obligations to the franchisee including any assistance in:

(i) Locating a site and negotiating the purchase or lease of the site.

(A) Disclose whether the franchisor generally owns the premises and leases it to

the franchisee;

(B) Whether the franchisor selects the site or approves an area within which the

franchisee selects a site. Disclose further how and whether the franchisor must

approve a franchisee-selected site;

(C) The factors that the franchisor considers in selecting or approving sites

(e.g., general location and neighborhood, traffic patterns, parking, size,

physical characteristics of existing buildings, and lease terms);

(D) The time limit for the franchisor to locate or to approve or disapprove the

site. Disclose further the consequences if the franchisor and franchisee cannot

agree on a site.

(ii) Conforming the premises to local ordinances and building codes and

obtaining any required permits;

(iii) Constructing, remodeling, or decorating the premises;

(iv) Hiring and training employees; and

(v) Providing for necessary equipment, signs, fixtures, opening inventory, and

supplies. In addition, disclose further:

(A) Whether the franchisor provides these items directly or merely provides the

names of approved suppliers;

(B) Whether the franchisor provides written specifications for

these items; and

(C) Whether the franchisor delivers or installs these items;

(2) Disclose the typical length

of time between the signing of the franchise agreement or the first payment of

consideration for the franchise and the opening of the franchisee's business.

Describe the factors that may affect the time period such as ability to obtain a

lease, financing or building permits, zoning and local ordinances, weather

conditions, shortages, or delayed installation of equipment, fixtures, and

signs.

(3) Disclose the franchisor's

obligations to the franchisee during the operation of the franchise, including

any assistance in:

(i) Developing products or services to be offered by the franchisee to its

customers;

(ii) Hiring and training employees;

(iii) Improving and developing the franchised business;

(iv) Establishing prices;

(v) Establishing and using administrative, bookkeeping, accounting, and

inventory control procedures; and

(vi) Resolving operating problems encountered by the franchisee.

(4) Describe the advertising

program for the franchise system. Disclose the following:

(i) The franchisor's obligation to conduct advertising, including:

(A) The media the franchisor may use;

(B) Whether media coverage is local, regional, or national;

(C) The source of the advertising (e.g., an in house advertising department or a

national or regional advertising agency); and

(D) Whether the franchisor must spend any amount on advertising in the area or

territory where the franchisee is located.

(ii) Disclose the conditions under which the franchisor permits franchisees to

use their own advertising material.

(iii) Disclose whether there is an advertising council composed of franchisees

that advises the franchisor on advertising policies. If so, disclose:

(A) How members of the council are selected;

(B) Whether the council serves in an advisory capacity only or has operational

or decision making power; and

(C) Whether the franchisor has the power to form, change, or dissolve the

advertising council.

(iv) Disclose whether the franchisee must participate in a local or regional

advertising cooperative. If so, disclose:

(A) How the area or membership of the cooperative is defined;

(B) How much the franchisee must contribute to the fund and whether other

franchisees are required to contribute at a different rate;

(C) Whether the franchisor-owned outlets must contribute to the fund and, if so,

whether it is on the same basis as franchisees;

(D) Who is responsible for administration of the cooperative (e.g., franchisor,

franchisees, or advertising agency);

(E) Whether cooperatives must operate from written governing documents and

whether the documents are available for review by the franchisee;

(F) Whether cooperatives must prepare annual or periodic financial statements

and whether the statements are available for review by the franchisee; and

(G) Whether the franchisor has the power to require cooperatives to be formed,

changed, dissolved, or merged.

(v) Disclose whether the franchisee must participate in any other advertising

fund. If so, disclose:

(A) Who contributes to the fund;

(B) How much the franchisee must contribute to the fund and whether other

franchisees are required to contribute at a different rate;

(C) Whether the franchisor owned outlets must contribute to the fund and, if so,

whether it is on the same basis as franchisees;

(D) Who administers the fund;

(E) Whether the fund is audited and when it is audited;

(F) Whether financial statements of the fund are available for review by the

franchisee; and

(G) Use of the fund in the most recently concluded fiscal year, the percentages

spent on production, media placement, administrative expenses, and a description

of any other use.

(vi) If all advertising funds are not spent in the fiscal year in which they

accrue, explain how the franchisor uses the remaining amount. Indicate whether

franchisees will receive a periodic accounting of how advertising fees are

spent.

(vii) Disclose the percentage of advertising funds, if any, that the franchisor

uses principally to solicit new franchise sales.

(5) Disclose whether the

franchisor requires the franchisee to buy or use electronic cash registers or

computer systems. If so, describe the systems generally in non-technical

language.

(i) Identify each hardware component and software program by brand, type, and

principal functions.

(A) If the hardware component or software program is the proprietary property of

the franchisor, an affiliate, or a third party, state whether the franchisor, an

affiliate, or a third party has the contractual right or obligation to provide

ongoing maintenance, repairs, upgrades, or updates. Disclose the current annual

cost of any optional or required maintenance and support contracts, upgrades,

and updates;

(B) If the hardware component or software program is the proprietary property of

a third party, and no compatible equivalent component or program has been

approved by the franchisor for use with the system to perform the same

functions, identify the third party by name, business address, and telephone

number, and state the length of time the component or program has been in

continuous use by the franchisor and its franchisees;

(C) If the hardware component or software program is not proprietary, identify

compatible equivalent components or programs that perform the same functions and

indicate whether they have been approved by the franchisor.

(ii) State whether the franchisee has any contractual obligation to upgrade or

update any hardware component or software program during the term of the

franchise and, if so, whether there are any contractual limitations on the

frequency and cost of the obligation.

(iii) For each electronic cash register system or software program, describe how

it will be used in the franchisee's business, and the types of business

information or data that will be collected and generated. State further whether

the franchisor will have independent

access to the information and data and, if so, whether there are any contractual

limitations on the franchisor's right to access theinformation and data.

(6) Disclose the table of contents of the franchisor's operating manual(s) provided to franchisees as of the franchisor's last fiscal year end or a more recent date. State further the number of pages devoted to each subject and the total number of pages in the manual as of this date. Alternatively, this disclosure may be omitted if the prospective franchisee views the manual before purchase of the franchise.

(7) Disclose the franchisor's

training program as of the franchisor's last fiscal year end or a more recent

date.

(i) Describe the nature of the training program summarized in tabular form, as

follows:

Training Program

----------------------------------------------------------------------------------------------------------------

Hours of classroom Hours of on the job

Subject training training Location

----------------------------------------------------------------------------------------------------------------

(A) In column (1), state the subjects taught.

(B) In column (2), state the hours of classroom training for each subject.

(C) In column (3), state the hours of on the job training for each subject.

(D) In column (4), state the location of the training for each subject.

(ii) Disclose how often training classes are held and the nature of the location

or facility where training is held (e.g., company, home, office, franchisor

owned store).

(iii) Describe the nature of instructional materials and the instructor's

experience. State the length of experience of the instructor in the field and,

specifically, with the franchisor. State only the experience that is relevant to

the subject taught and the

franchisor's operations;

(iv) Disclose any charges franchisees must pay for training and who must pay

travel and living expenses of the enrollees in the training program;

v) Disclose who may and who is required to attend the training. State whether

the franchisee or other persons must complete the program to the franchisor's

satisfaction. If successful completion is required, state how long after the

signing of the agreement or before the opening of the business the training must

be completed. If training is not mandatory, state the percentage of new

franchisees that enrolled in the training program during the preceding 12

months; and

(vi) Whether any additional training programs and/or refresher courses are

required.

FRANCHISE DISCLOSURE ITEM 12

ITEM 12: Territory.

(1) Disclose the following

information concerning the franchisee's market area (with or without an

exclusive territory):

(i) If applicable, the minimum area granted to the franchisee (e.g., a specific

radius, a distance sufficient to encompass a specified population, or another

specific designation);

(ii) Whether the franchise is granted for a specific location or a location to

be approved by the franchisor;

(iii) Any conditions under which the franchisor will approve the relocation of

the franchised business or the franchisee's establishment of additional

franchised outlets;

(iv) Whether the franchisor has established or may establish another franchisee

who may also use the franchisor's trademark within the defined area;

(v) Whether the franchisor has established or may establish franchisor owned

outlets or other channels of distribution using the franchisor's trademark

within the defined area;

(vi) Whether the franchisor or its affiliate has established or may establish

other franchises or franchisor-owned outlets or another channel of distribution

selling or leasing similar products or services under a different trademark

within the defined area;

(vii) Restrictions on the franchisor regarding operating franchisor owned stores

or on granting franchised outlets for a similar or competitive business within

the defined area; (viii) Restrictions on franchisees from soliciting or

accepting orders outside of their defined territories;

(ix) Restrictions on the franchisor from soliciting or accepting orders inside

the franchisee's defined territory. State further any compensation that the

franchisor must pay for soliciting or accepting orders inside the franchisee's

defined territories; and

(x) Franchisee options, rights of first refusal, or similar rights to acquire

additional franchises within the territory or contiguous territories.

(2) Describe any exclusive

territory granted the franchisee.

(i) If the franchisor grants an exclusive territory, disclose:

(A) Whether continuation of the franchisee's territorial exclusivity depends on

achievement of a certain sales volume, market penetration, or other contingency,

and under what circumstances the franchisee's territory may be altered. Specify

any sales or other conditions. State the franchisor's rights if the franchisee

fails to meet the requirements; and

(B) Any other circumstances that permit the franchisor to modify the

franchisee's territorial rights (e.g., a population increase in the territory

giving the franchisor the right to grant an additional franchise within the

area), and the effect of such modifications on the franchisee's rights;

(ii) If the franchisor does not grant exclusive territories, state:

``You will not receive an exclusive territory. [Franchisor] may establish other

franchised or franchisor-owned outlets that may compete with your location.''

(3) If the franchisor or an

affiliate operates, franchises, or has present plans to operate or franchise a

business under a different trademark and that business sells goods or services

similar to those to be offered by the franchisee, describe:

(i) The similar goods and services;

(ii) The trade names and trademarks;

(iii) Whether outlets will be franchisor owned or operated:

(iv) Whether the franchisor or its franchisees who use the different trademark

will solicit or accept orders within the franchisee's territory;

(v) A timetable for the plan;

(vi) How the franchisor will resolve conflicts between the franchisor and the

franchisees and between the franchisees of each system regarding territory,

customers or franchisor support; and

(vii) The principal business address of the franchisor's similar operating

business. If it is the same as the franchisor's principal business address

disclosed in paragraph (a) of this section, disclose whether the franchisor

maintains (or plans to maintain) physically

separate offices and training facilities for the similar competing business.

FRANCHISE DISCLOSURE ITEM 13

ITEM 13: Trademarks.

(1) Disclose each principal trademark to be licensed to the franchisee. For purposes of this Item, ``principal trademark'' means the primary trademarks, service marks, names, logos, and commercial symbols to be used by the franchisee to identify the franchised business. It does not include every trademark owned by the franchisor.

(2) For each principal trademark,

disclose whether the trademark is registered with the United States Patent and

Trademark Office.

(i) For each registration, state:

(A) The date and identification number of each trademark registration or

registration application;

(B) Whether the franchisor has filed all required affidavits;

(C) Whether any registration has been renewed; and

(D) Whether the principal trademarks are registered on the Principal or

Supplemental Register of the U.S. Patent and Trademark Office, and if not,

whether an ``intent to use'' application or an application based on actual use

has been filed with the U.S. Patent and

Trademark Office.

(ii) If the trademark is not registered on the Principal Register of the U.S.

Patent and Trademark Office, state: ``By not having a Principal Register federal

registration for [name or description of symbol], [name of franchisor] does not

have certain presumptive legal rights granted by a registration.''

(3) Disclose any currently

effective material determinations of the U.S. Patent and Trademark Office, the

Trademark Trial and Appeal Board, or the trademark administrator of any State or

court; and any pending infringement, opposition, or cancellation proceeding.

Include infringement, opposition, or cancellation proceedings in which the

franchisor unsuccessfully sought to prevent registration of a trademark in order

to protect a trademark licensed by the franchisor. Describe how the

determination affects the franchised business.

(4) Disclose any pending material

federal or State litigation regarding the franchisor's use or ownership rights

in a trademark. For each pending action, franchisors may include a summary

opinion of counsel concerning any action if a consent to use the summary opinion

is included as part of the disclosure document.

(i) The forum and case number;

(ii) The nature of claims made opposing the franchisor's use or by the

franchisor opposing another person's use; and

(iii) Any effective court or administrative agency ruling concerning the matter.

(5) Disclose agreements currently

in effect that significantly limit the rights of the franchisor to use or

license the use of trademarks listed in this Item in a manner material to the

franchise. For each agreement, disclose:

(i) The manner and extent of the limitation or grant;

(ii) The extent to which the franchisee may be affected by the agreement;

(iii) The agreement's duration;

(iv) The parties to the agreement;

(v) The circumstances under which the agreement may be canceled or modified; and

(vi) All other material terms.

(6) Disclose whether the

franchisor must protect the franchisee's right to use the principal trademarks

listed in this Item, and must protect the franchisee against claims of

infringement or unfair competition arising out of the franchisee's use of the

trademarks. Disclose further:

(i) The franchisee's obligation to notify the franchisor of the use of, or

claims of rights to, a trademark identical to or confusingly similar to a

trademark licensed to the franchisee;

(ii) Whether the franchise agreement requires the franchisor to take affirmative

action when notified of these uses or claims. Identify who has the right to

control administrative proceedings or litigation;

(iii) Whether the franchise agreement requires the franchisor to participate in

the franchisee's defense and/or indemnify the franchisee for expenses or damages

if the franchisee is a party to an administrative or judicial proceeding

involving a trademark licensed by the franchisor to the franchisee, or if the

proceeding is resolved unfavorably to the franchisee; and

(iv) The franchisee's rights under the franchise agreement if the franchisor

requires the franchisee to modify or discontinue the use of a trademark.

(7) Disclose whether the

franchisor actually knows of either superior prior rights or infringing uses

that could materially affect the franchisee's use of the principal trademarks in

the State in which the franchised business is to be located. For each use of a

principal trademark that the franchisor believes constitutes an infringement

that could materially affect the franchisee's use of a trademark, disclose:

(i) The nature of the infringement;

(ii) The location(s) where the infringement is occurring;

(iii) The length of time of the infringement (to the extent known); and

(iv) Action taken by the franchisor.

FRANCHISE DISCLOSURE ITEM 14

ITEM 14: Patents, Copyrights, and Proprietary Information.

(1) Disclose whether the

franchisor owns rights in patents or copyrights that are material to the

franchise. For each patent or copyright:

(i) Describe the patent or copyright and its relationship to the franchise;

(ii) State the duration of the patent or copyright;

(iii) For copyrights, state:

(A) The registration number and date of each copyright; and.

(B) Whether the franchisor can and intends to renew the copyright.

(iv) For patents, state:

(A) The patent number, issue date, and title for each patent, and the serial

number, filing date, and title of each patent application; and

(B) Describe the type of patent or patent application (e.g., mechanical,

process, or design).

(2) Describe any current material determination of the U.S. Patent and Trademark Office, the U.S. Copyright Office, or a court regarding the patent or copyright. Include the forum and case number. Describe how the determination affects the franchised business.

(3) State the forum, case number, claims asserted, issues involved, and effective determinations for any material proceeding pending in the U.S. Patent and Trademark Office or the U.S. Court of Appeals for the Federal Circuit. Franchisors may include a summary opinion of counsel concerning any action if a consent to use the summary opinion is included as part of the disclosure document. Franchisors may include a summary opinion of counsel concerning any action if a consent to use the summary opinion is included as part of the disclosure document.

(4) If an agreement limits the use of the patent, patent application, or copyright, state the parties to and duration of the agreement, the extent to which the franchisee may be affected by theagreement, and other material terms of the agreement.

(5) Disclose the franchisor's

obligation to protect the patent, patent application, or copyright and to defend

the franchisee against claims arising from the franchisee's use of the patented

or copyrighted items. Disclose further:

(i) Whether the franchisee must notify the franchisor of claims or infringements

or if the action is discretionary;

(ii) Whether the franchise agreement requires the franchisor to take affirmative

action when notified of infringement. Disclose who has the right to control

litigation;

(iii) Whether the franchisor must participate in the defense of a franchisee or

indemnify the franchisee for expenses or damages in a proceeding involving a

patent, patent application, or copyright licensed to the franchisee;

(iv) Requirements that the franchisee modify or discontinue use of the subject

matter covered by the patent or copyright; and

(v) The franchisee's rights under the franchise agreement if the franchisor

requires the franchisee to modify or discontinue use of the subject matter

covered by the patent or copyright.

(6) If the franchisor actually

knows of an infringement that could materially affect the franchisee, disclose:

(i) The nature of the infringement;

(ii) The location where the infringement is occurring;

(iii) The length of time of the infringement; and

(iv) Action taken or anticipated by the franchisor.

(7) If the franchisor claims

proprietary rights in other confidential information or trade secrets, describe

in general terms the proprietary information communicated to the franchisee and

the terms and conditions for use by the franchisee. The franchisor need

only describe the general nature of the proprietary information, such as whether

a formula or recipe is considered to be a trade secret.

FRANCHISE DISCLOSURE ITEM 15

ITEM 15: Obligation to Participate in the Actual Operation of the Franchise

Business.

(1) Disclose the franchisee's obligation to participate personally in the direct operation of the franchise business and whether the franchisor recommends participation. Include obligations arising from any written agreement or from the franchisor's practice.

(2) If personal ``on-premises''

supervision is not required, disclose the following:

(i) If the franchisee is an individual, state:

(A) Whether the franchisor recommends on premises supervision by the franchisee;

(B) Limitations on whom the franchisee can hire as an on premises supervisor,

and

(C) Whether an on-premises supervisor must successfully complete the

franchisor's training program.

(ii) If the franchisee is a business entity, state the amount of equity interest

that the on premises supervisor must have in the franchise.

(3) Disclose any restrictions that the franchisee must place on its manager (e.g., maintain trade secrets, covenants not to compete).

FRANCHISE DISCLOSURE ITEM 16

ITEM 16: Restrictions on What the Franchisee May Sell.

Disclose any franchisor-imposed restrictions or conditions on the goods or services that the franchisee may sell or that limit the franchisee's customers. Disclose further:

(1) Any obligation on the franchisee to sell only goods and services approved by the franchisor;

(2) Any obligation on the franchisee to sell all goods and services authorized by the franchisor;

(3) Whether the franchisor has the right to change the types of authorized goods and services and whether there are limits on the franchisor's right to make changes; and

(4) Any restrictions on the franchisee's customers.

FRANCHISE DISCLOSURE ITEM 17

ITEM 17: Renewal, Termination, Transfer, and Dispute Resolution.

Disclose, in the tabular form

shown below, a table that cross references each enumerated franchise

relationship item with the applicable provision in the franchise or related

agreement. Summarize briefly each contractual provision. If a particular item is

not applicable, state ``Not Applicable.'' If the agreement is silent concerning

one of the listed provisions, but the franchisor unilaterally offers to provide

certain benefits or

protections to franchisees as a matter of policy, use a footnote to describe

this policy and state whether the policy is subject to change. This table lists

certain important provisions of the franchise and related agreements. You should

read these provisions in the agreements attached to this disclosure document.

------------------------------------------------------------------------

Provision Section in Franchise Agreement Summary

------------------------------------------------------------------------

a. Length of the franchise term

b. Renewal or extension of the term.

c. Requirements for franchisee to renew or extend.

d. Termination by franchisee.

e. Termination by franchisor without cause.

f. Termination by franchisor with cause.

g. ``Cause'' defined curable defaults.

h. ``Cause'' defined noncurable defaults.

i. Franchisee's obligations on termination/non renewal.

j. Assignment of contract by franchisor.

k. ``Transfer'' by franchisee defined.

l. Franchisor approval of transfer by franchisee.

m. Conditions for franchisor approval of transfer.

n. Franchisor's right of first refusal to acquire franchisee's business.

o. Franchisor's option to purchase franchisee's business.

p. Death or disability of franchisee.

q. Non compete covenants during the term of the franchise.

r. Non compete covenants after the franchise is terminated or expires.

s. Modification of the agreement.

t. Integration merger clause

u. Dispute resolution by arbitration or mediation.

v. Choice of forum.

w. Choice of law.

FRANCHISE DISCLOSURE ITEM 18

ITEM 18: Public Figures.

Disclose the following information about any public figures involved in the franchise. A public figure means a person whose name or physical appearance is generally known to the public in the geographic area where the franchise will be located.

(1) Any compensation paid or promised to a public figure arising from either the use of the public figure in the franchise name or symbol; or the endorsement or recommendation of the franchise to prospective franchisees.

(2) The extent to which the public figure is involved in the actual management or control of the franchisor. Describe the public figure's position and duties in the franchisor's business structure.